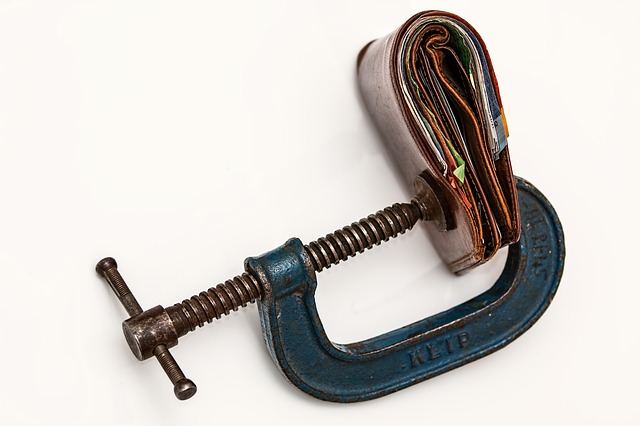

Are you weighed down by your credit card bills? Is your credit card balance getting way out of hand? It seems a lot easier if you just ignore it, but unfortunately it will haunt you if left unmanaged. You probably had a good reason for running up a high-interest debt. Maybe you had to make unexpected big-ticket purchases? Maybe you suddenly lost your job or endured an unexpected illness? Regardless of the cause for your credit card debt, your top financial priority should be paying it off. You will definitely need an action play to help you reduce and eventually eliminating the balance you owe.

Here are 5 tips for paying off your credit card debt:

- Eliminate your Credit Cards

The firs thing you should do is to stop the bleeding. Therefore, you should eliminate your credit cards, especially your most expensive card first. You should pay the monthly minimum on each card to avoid fees, but make sure you apply any leftover money to the highest interest rate credit card first. Once you pay off that card, you should take the amount you were paying and apply it to your credit card with the second highest interest rate while continuing to make minimum payments.

- Free up Cash

You can free up cash by pausing on some of your spending. You should identify some of your automated payments that can be eliminated or temporarily pause while you’re paying off your credit card debt. In addition, reduce or delay any large annual expenses such as vacations to help you reduce your costs. You can also come up with extra money to boost your income in order to eliminate your credit card balance.

- Create a Written Budget

Creating a written budget will help you stay out of debt in the future. You should plan to save up by allocating some of your spending to an emergency fund to be prepared for unexpected big-ticket purchases, a job loss or an illness. Make sure you check with your budget each month to help you stay on track of your written budget. You can use apps like Mint on your phone to keep track of your budgeting.

- Set Financial Goals

You should figure out what is the most important to you and keep this in mind as you work your way to reducing your debt. Are you looking to buy a home? Save for that car you’ve always wanted? Or go on that trip you’ve never thought that was possible? Setting financial goals and reminding yourself of them will help you stay focused and drive you to achieve your financial goals.

- Consolidate your Debt

Debt consolidation is a form of debt financing. You can take advantage of consolidating your debt by taking out one loan to pay off many others. Did you know that you can use your home equity to reduce your credit card debt? If you are Canadian, you can take advantage of refinancing some of the equity in your mortgage to reduce your credit card debt. Why should you pay high interest rates on your credit card debt when you can add that debt to your mortgage in order to pay a much lower interest rate?

Credit card bills can weigh you down, especially if it’s getting way out of hand. If this is left unmanaged, it will haunt you as your debt increases. So, the most important lesson is knowing where your money is going. Don’t you want to be debit free and enjoy your financial freedom? Money doesn’t only provide benefits to you financially, it can also touch all aspects of your life, personally and emotionally.