A gold loan is one of the main sources of financing a need in India today. You can apply for a loan against gold jewellery and easily avail up to Rs. 50 lakhs. It is the easiest and fastest means of getting funds. Some banks and NBFCs can disburse the amount within 2 hours. Gold loans are also cheap compared to several unsecured loans, with interest rate starting from 10.50%. It is a secured loan, where you need to keep the ornaments as collateral, which are released once the repayment is complete. The journey of gold loan began from rural India as a way of financing the agriculture sector, and now, not only farmers, but anyone can take this loan.

How Did Gold Loans Evolve Into a Reliable Funding Source?

Such loans are not a new phenomenon. The origin dates back to the time when barter system existed. Against gold, people used to barter other essential goods and rations. Jewellers in the past were the ones who used to lend money against the ornaments to poor farmers and needy individuals. The margin kept by lenders were as high as 50% but today the financial institutions can offer up to 75% of the gold’s value. The rate of interest is also monitored.

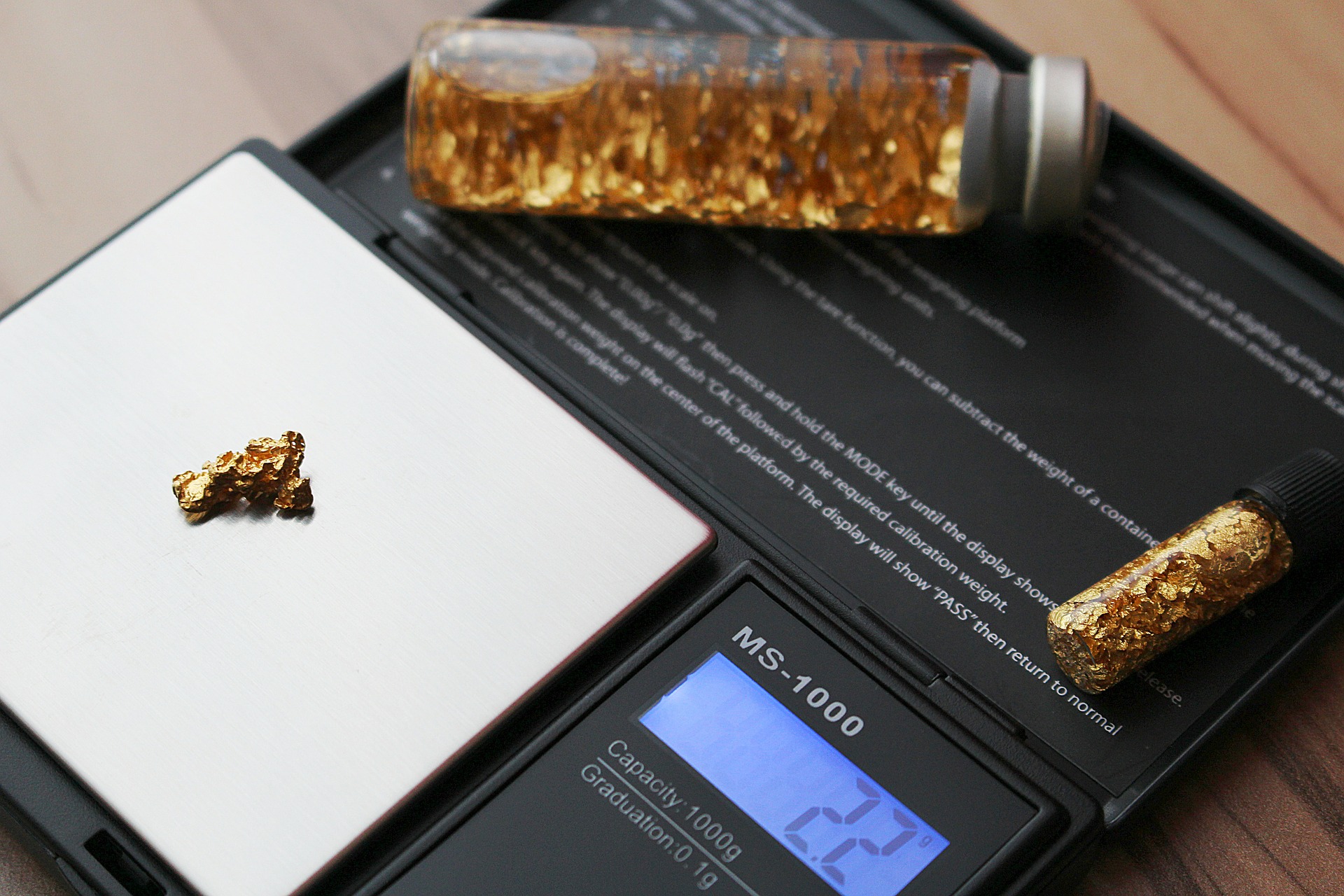

Thus, with gold loan system becoming transparent and formalized, and highly regulated, act as a saviour for those who require money quickly and for personal or any expenses. During gold evaluation, the jewellery is checked for authenticity, purity, and weight. Only the gold content in the ornament is considered for accounting the loan amount. Other material or gemstones are not counted in, since those are not a part of gold loan.

Even though there are many options in line of credit like personal loans, payday loans etc; gold loans are predominant in the Indian market of lending, and stay relevant to the day. You may ask why, here is the answer.

- Anyone Can Get a Gold Loan: The loan on gold unlike other traditional and contemporary loans can be provided to homemakers and unemployed individuals as well as salaried, professional, businessperson etc. It is difficult to get any secured or unsecured loan otherwise, if the applicant does not draw a regular monthly income. However, jewellery loan relaxes the eligibility criteria and includes all citizens. As long the gold you own is above 18 carats, and in form of ornaments, you can obtain the funds. Gold bars, biscuits, and coins generally are not preferred to offer funds.

- Added Benefits: Non-banking companies and banks aggressively promote loans against gold, and this credit facility is equally popular in urban areas as much as in villages. As in Indian households, gold assets are common; citizens find it as convenient route to obtain finances during emergencies. As this loan can be given within a short time, people moreover prefer it.

- Minimal Documentation: Another reason why a loan against gold is still in vogue is because of the simple documentation process. Usually for other loans, you need to produce income documents, income tax return proof, financial statements, salary slips, bank statements, credit report etc. However, in gold loan, all you require is the basic KYC documents, which includes identity proof and residence proof. Yes, it is that simple and effortless. Those who possess sufficient gold ornaments thus choose a loan on the precious metal than any kind of loans available in the market.

- Repayment Terms: The tenure is up to 2 years, or maximum 3 years. You can repay the interest amount till the tenure last, and the principal amount at the end of the term. Thus, gold loan repayment is free of EMI, while you have to pay regular EMIs to repay other loans.

- Free Security for the Ornaments: The jewellery receives complete security, in a way that these are kept in high-security lockers by the financial institution. Thus, the ornaments cannot be misused or replaced and the risk of losing the precious metal to theft also reduces, greatly. You can be free of any worries when taking a loan on gold, because the asset remains safe, and taking funds on the asset is so much better than selling off the asset.

- Short Tenure: One of the reasons why a gold loan is popular today is because it is a short-term borrowing. There is no long-term of interest payment, thus the burden of payment reduces. You can get done with repayment within 2 years. Most of the financial institutes do not even charge a prepayment penalty, only a few do, if you intend to repay before the end of a specific period. This means, you can repay the loan as soon as you can and save maximum.

- No Restriction on Purpose of the Loan: Last but not the least, gold loans though secured loans, do not restrict how you use the funds, unlike other secured loans, such as home loans, and loan against property. You can utilize the funds for just about anything, like buying a gadget, home renovation, marriage, travel, medical treatment, investment, business etc. Thus, it acts almost as a personal loan, but with fewer restrictions, documents, no credit check, and several benefits.

Gold loan is thus a reliable means to finance your monetary needs. It is popular because of a variety of reasons, some of which we have mentioned above.